Most people concerned about their credit score only focus on their FICO number. As a result many throw away good money when they sign up for products and services the company sells.

Don’t get me wrong – the company that sells the FICO score (Fair Isaac) is honest and fair as far as I know. But that doesn’t mean you have to send them money for useless information.

I know this sounds like a bold statement – but have patience, read this post entirely, and if you don’t agree with me by the time you are done, let me know and let me know why. I’ll be happy to discuss further in the comments section below.

In order to understand what I’m saying, you have to know a little about the credit data industry.

How The Credit Information Industry Works

As consumers, we use our credit cards 30 billion times each year. And every time we do, the data is recorded. Who records this data? Glad you asked.

There are a number of companies that do but the 3 big companies that track our credit transactions are Experian, Equifax, and TransUnion. These companies are hugenormous and are referred to as CRAs (credit reporting agencies).

These CRAs collect data on the 30 plus billion transactions that consumers make every year and sell that data to companies who want to review your credit report before they offer you credit, a job, life insurance or whatever.

In addition, they also sell the information to credit scoring companies – like FICO. You might think FICO is the only credit scoring company out there but that’s not so.

The other major provider of credit scores is VantageScore. In addition, Quizzle, Credit Karma, Credit Sesame, Lending Tree, Credit Wise, Nerd Wallet, My Bank Rate, and Wallet Hub also market credit scores but they simply use the VantageScore number, massage it a bit and spit out a slightly different result.

Anyway, all the credit scoring companies mentioned above (including Fair Isaac) take our credit histories from the CRAs and assign a number (score) to represent how safe (or risky) they think we are as borrowers based on their own algorithm.

Vendors pay these credit scoring companies to obtain our scores. They use that score to decide whether or not to offer us credit and if so, on what terms.

As I said at the start of this post, FICO is the company most people think of when they think about their credit scores. But the credit reporting agencies thought they could do a better job than FICO at scoring consumers so they are the ones that created VantageScore.

As I said, there are also a number of other credit scoring companies which base their credit score on the number they get from VantageScore.

How Your FICO Score Differs From Your VantageScore

Lenders are all interested in one thing; will you repay your loan on time or not? Towards that end, they consider:

- Have you made your credit payments consistently and on time in the past?

- How long have you had credit?

- What types of credit do you have?

- What percentage of your available credit have you actually used?

- How often are credit inquiries being made?

Although both FICO and VantageScore consider much of the same information, they gather their data in different ways. And they evaluate the information differently as well.

First, if you just started building your credit history, VantageScore will likely rank you higher than FICO (all things being equal). Unlike FICO (which requires six months history), VantageScore only requires one month’s history.

Also the VantageScore number is more dynamic. They pay attention to how your credit indicators are trending (are they improving, getting worse or staying the same) rather than just looking at your situation at a static point in time.

There’s more. VantageScore weights late payments differently than FICO and depending on your credit history, this could work to your benefit or detriment.

FICO treats all late payments the same. But VantageScore puts heavier penalties on late mortgage payments.

In other words, if you’ve been really good about making your mortgage payments but maybe not so good about making payments on other debts, your VantageScore might be higher than your FICO score.

Lenders Will Flock To The Most Effective Score

Lenders have a strong incentive to use the most reliable scoring service possible.

Let’s look at an example. If you were a lender and felt that VantageScore was better predictor of who would and who would not pay back loans, you’d be interested in their services, right?

After all, if the bank or other financial institution can reduce the number of non-performing loans it makes, it will be much more profitable.

Also, banks who have a better way to weed out bad borrowers from good ones can offer cheaper loans to the people they want to do business with. With that in mind let’s consider…..

Which Lenders Care About Which Score?

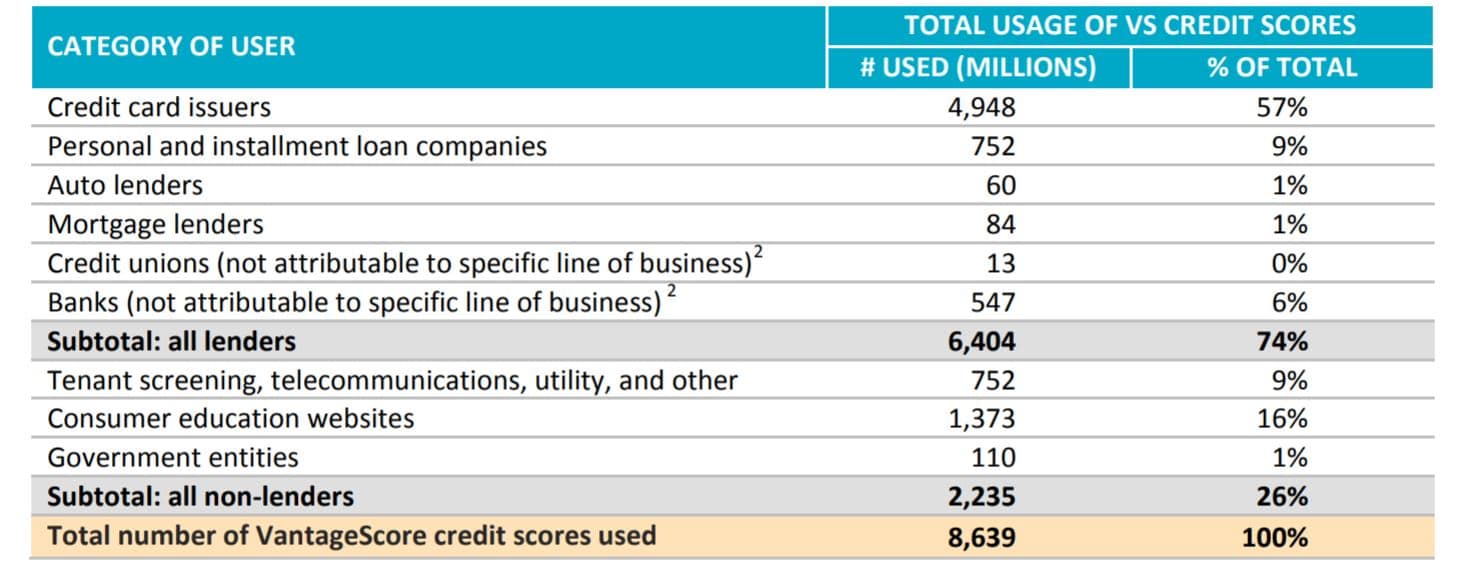

As you can see (below) more and more credit card companies rely heavily on VantageScore.

57% of the credit card inquiries go through VantageScore while most of the other industries (such as mortgages) turn to other scoring services when they check us out – probably FICO.

2017 VANTAGESCORE MARKET STUDY REPORT

What You Should Do With This Information

The reality is that when you apply for a loan you can’t control which credit scoring company the would-be lender gets information from.

If you are trying to get lower cost credit cards, VantageScore might be a better score to check out.

If you want to get a mortgage, FICO might be a bit better, but as I said, you can’t control which scoring company your lender is going to use.

In fact, the only thing you can control is your spending and payment behavior. Over the long run, the same good credit behaviors (paying bills on time, not maxing out your available credit etc) will help you get a better score with both scoring companies.

There might be a few hacks you can use to quickly juice up one score or the other in the short term. But if your goal is to increase your credit score permanently and over the long haul, the actions you need to take are fairly clear and well known and will work in both scoring models.

That being the case, don’t waste your precious time worrying about which credit score to apply for. Instead, find the cheapest source of credit scores, track your number and do everything you can to improve and maximize your credit profile.

As it happens, there are several ways to get your free VantageScore credit score and not so many ways to get a free FICO score. (FICO actually offers a variety of different credit scores and the watered down versions can be had for free but that won’t really track what your lenders are looking at.)

Spend your precious time on things that matter – and save your money rather than throwing it away. When it comes to paying to track your credit score, just say no.

User Generated Content (UGC) Disclosure: Please note that the opinions of the commenters are not necessarily the opinions of this site.