You might be confused over how much to contribute to 401k plans at work – or even if you should contribute or not. For now, let’s talk about the confusion over the amount to put in. It is puzzling. That’s because there are actually two sets of rules. The most important guidelines are set down […]

Retirement Planning

This category is the heart and soul of Wealth Pilgrim. Here you’ll find a host of information created to help you reach your retirement goals and enjoy the journey. These are nuts-and-bolts articles to help you understand where you are now, identify where you want to be and when you want to get there, and design a roadmap to help you do so.

How Much Money Should I Save?

I hate to admit this. I really do. But even though I’m a professional financial planner I didn’t even think to ask myself “ How much money should I save ” until ten years ago. I just saved everything I possibly could. I didn’t grow up in poverty but my family really struggled financially while […]

9 Crucial Questions about Retirement People Forget To Ask

You probably have questions about your retirement no matter how young or old you are. I know it’s true because people at all stages of life write and ask me to clarify retirement issues all the time. What I find interesting is that while the questions they do ask are almost always good questions they […]

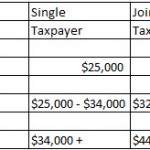

Are Social Security Benefits Taxable?

If you are retired or are planning your retirement it’s natural to ask if social security benefits are taxable or not. And if they are taxable, the next question is, what can you do (if anything) to reduce your tax burden? First let’s understand how social security benefits are taxed. The first thing our friends […]

How To Retire Without A Retirement Plan

People automatically think about retirement plans when they try to figure out how to retire . That’s because when it comes to having enough money to retire, the tax deductibility of qualified plans provides a significant boost to investment returns. But some of your best retirement assets may be investments that aren’t tax deferred in […]

Longevity Insurance – Guaranteed Income For Life – Is This Real?

Longevity insurance is a policy that gives guaranteed income for life and this is a very hot topic. Just about everyone you know wonders if they are going to have enough money to retire or not. They may not talk about it but believe me…they’re thinking about it. How does longevity insurance work? It really […]