There are no two ways about it. It’s been frightening for investors for the last 6 months. Are things going to turn around soon or get a lot worse?

Of course, nobody knows what the future holds for the stock market. But one thing I do know is the media is really terrible at helping us make good investment decisions.

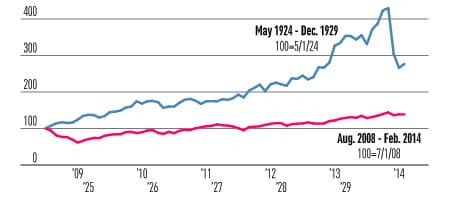

Here is a graph that circulated a few years ago. It shows the pattern of the market through 2013 against the pattern leading up to the 1929 crash. The suggestion was that our market was just about to go over the ledge. Take a look yourself:

When you first see this, what is your reaction? Is it fear? If so, you aren’t alone. Lots of people got the wits scared out of them when they first saw this graph.

But was it true or helpful? As it turned out, no. The market returned 11.14% in 2014. And 2015 was a little bit below break even. In other words, the parallel that the media tried to draw was all smoke and mirrors.

And by the way, the folks who put that visual together used different scales to match up the graphics. If the patterns had been drawn to scale they would look nothing like each other. See for yourself.

And even if the patterns were to scale, it wouldn’t mean a thing. The conditions that resulted in the Crash of 1929 are very different from the conditions today.

Why This Is Important To You

Even if you didn’t see the naughty little graph, you can learn a lot by observing your own reactions when you first see this suggestion that doomsday is just around the bend.

It’s only natural to be frightened once in a while if you are an investor. In fact, that was the intent of the people who finagled this data. They did it in order to kidnap your attention and sell advertising. The problem is that some folks might be swayed by their fear and make investment moves they will later regret. Don’t fall into this trap.

Yes, the stock market is frightening at times. The short-term future is unknown and unknowable. But if you believe that (which I hope you do) you must also accept that a graph can’t accurately predict the future either.

Just because some geek knows how to manipulate data on an excel spreadsheet doesn’t mean he or she knows a thing about the market. Graphs, tea leaves or planets aligning are no good at helping you make good investment decisions. Stick to a good investment method instead. Make sure you measure your risk tolerance and then allocate accordingly. You’ll be far better off in the long-run.

Are you concerned about another stock market crash? Why or why not?

User Generated Content (UGC) Disclosure: Please note that the opinions of the commenters are not necessarily the opinions of this site.