How you think about money is responsible for 95% of where you are in your financial life in my experience. You don’t have to worry about that too much. I already know finances are important to you. If not, you wouldn’t be reading this post. That is a fantastic place to start from and it […]

What Are LEAPS?

LEAPS are long-term options on stocks. The word LEAPS is an acronym that stands for Long Term Equity AnticiPation Security. This sounds really complicated but it isn’t. With LEAPS and other options, you pay a premium for the right to buy shares at a fixed price for a certain time. You might pay $10 for […]

5 Situations When Spending More Than You Earn Is Genius

It’s a rule of thumb that you should not spend more than you earn. This is normally excellent advice. If you overspend relative to your income you can easily find yourself in a world of pain. But sometimes overspending is actually smart. In fact there are 5 situations where shelling out more than you bring […]

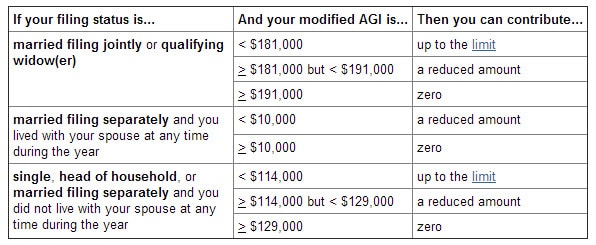

What Is A Roth IRA?

A Roth IRA is one type of retirement account you might want to fund. Then again, once you understand how it really works, you might want to give it a big “non merci”. It’s quite different from a traditional IRA. With the Traditional IRA, you get a write off in the year that you fund […]

9 Juicy Individual Tax Deductions Most Overlooked

Even if you really know your way around a 1040 tax form, chances are you are leaving money on the table every year. The good news is there are multiple tax deductions that you can find by looking at your family expenses, home expenses and the money that you spend every year for your job […]

When And How To Re-Title Your Assets

You work hard making money and doing your best to grow your assets. I know that and I commend you for it. I really do. But have you overlooked the proper way to title your assets? If so, all your hard work could be in vain. Let me give you an example to illustrate how […]