There is a very high likelihood that your retirement accounts are in big jeopardy – and I don’t mean the TV show. That’s true even if you’ve selected the right beneficiaries. The problem I’m talking about is your ability to tap that money should you become incapacitated. If you become disabled and are unable to […]

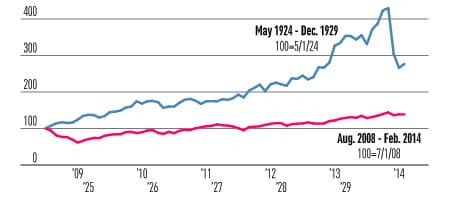

Is The Stock Market Going To Get Worse ?

There are no two ways about it. It’s been frightening for investors for the last 6 months. Are things going to turn around soon or get a lot worse? Of course, nobody knows what the future holds for the stock market. But one thing I do know is the media is really terrible at helping […]

How to Buy a Home When You Still Have Student Loans

This is a guest post by Andy Josuweit, CEO of Student Loan Hero. Andy has a fantastic site and it’s a great resource for any with a student loan. Do yourself a favor and check it out Pilgrim. The time it takes for college graduates to pay off their student loans can extend 10, 20 […]

Is A Non-Deductible IRA Worth It?

Not everybody can make deductible IRA contributions. But just because you aren’t able to claim a tax deduction for your IRA contribution in 2015, does that mean you should forget about the nondeductible IRA? Not necessarily. As you’ll see, it depends on your situation. First, let’s discover who is able to have a deductible IRA […]

Should You Put Your Safe Deposit Box Into Your Trust?

If you have a family living trust and a safety deposit box your attorney will probably tell you to retitle the bank box into the trust. This way, if something happens to you, your successor trustee will automatically have access to it. Smooth. To put the box into your trust all you have to do […]

Four Steps To Finding The Right Mutual Funds

Finding the best mutual funds is an art and a science. It is an art in that it’s subjective – a fund that suits you may not be the best choice for your neighbor. But there is science to it as well. Granted, there is no formula that can predict which funds will perform best […]