When you take a fixed amount from your investments or savings at fixed intervals you are taking a systematic withdrawal. So in other words, if you withdraw $500 from your account every month, that’s a systematic withdrawal. “Simplisimo”! Why Are Systematic Withdrawals Your Secret Weapon For Enhanced Retirement Income? Systematic withdrawals could be the key […]

Retirement Planning

This category is the heart and soul of Wealth Pilgrim. Here you’ll find a host of information created to help you reach your retirement goals and enjoy the journey. These are nuts-and-bolts articles to help you understand where you are now, identify where you want to be and when you want to get there, and design a roadmap to help you do so.

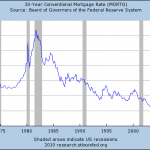

Planning Your Retirement without Worrying about High Interest Rates, Inflation or Income Taxes

Things are pretty good right now for investors. The market has been solid and inflation has been tame. But some people are concerned about the future. And I believe more will become increasingly anxious in the near term as interest rates start to go up. This is especially acute for retired people and for people […]

Why Turning Your 401k Into A Pension Is A Bad Idea

You may have heard about a recent Treasury Department ruling that allows investors to buy deferred income annuities (DIAs explained below) within 401k plans. DIA plans convert your 401k into a pension. Up until now you could make IRA contributions to DIAs but with this Treasury ruling target-date funds operating within a 401k or other […]

5 Retirement Hobbies that Will Save You a Fortune

Believe it or not, your retirement hobbies have a lot to do with your financial future. In fact, they could be the difference between having a successful retirement or not. Here’s why I say this. When you retire you’ll have lots of free time. If you don’t fill it up with some fulfilling activity, you’re […]

Retirement Lump Sum – Your Best Choice?

When you retire you want to reduce your worries and concerns. And besides health, there is nothing that retirees worry more about than income. That being the case, many are drawn to the idea of taking a monthly pension or payout from their retirement plan rather than the lump sum offer. There are benefits to […]

Do you really have a financial plan?

You might think you have a financial plan but in fact you may not. And believe it or not, the exact opposite of this is also true. You might not think you have a plan when in fact you do. In order to know if you have a financial plan or not we need to […]