Ever since the day you started working you probably started thinking about retirement….right? Of course this is a good thing. It motivates to save and invest. But on the other hand it can add huge pressure to your day-to-day life. That’s because a full retirement requires a huge wad of “Benjamins” that reach to the […]

Retirement Planning

This category is the heart and soul of Wealth Pilgrim. Here you’ll find a host of information created to help you reach your retirement goals and enjoy the journey. These are nuts-and-bolts articles to help you understand where you are now, identify where you want to be and when you want to get there, and design a roadmap to help you do so.

You Might Be More Prepared For Retirement Than You Think

Jim and Marie are in their mid-50’s and spend most every day worrying about their not-too-distant retirement. They are doing the best they can. They contribute to their 401ks and never carry a credit card balance. They even own 2 rentals. But they are sure they don’t have as much as they need to retire […]

Why and Where to Roll Over a 401k

It’s really simple to roll over a 401k, and if you’ve “separated from service” (lost your job or quit), you should do it. Roll your 401k to a self-directed IRA as soon as you can. Just make sure you do it right if you want to avoid the penalties. Here are the main benefits: 1. […]

Should We Sell Our Home and Become Renters?

Two fiends of mine just became instantly famous by selling their home and becoming renters. That’s right. Lynne and Tim Martin wrote a book about how they sold their home and became full-time, world-wide travelers. The book sold out on the first day it became available. All the major news outlets are begging Lynne and […]

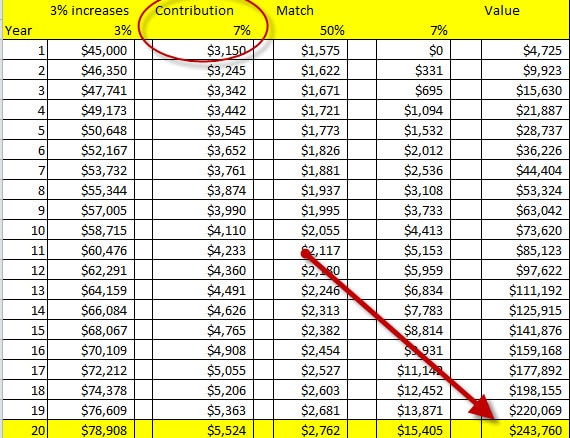

Am I Saving Enough Money?

When I sit down with people for the first time, one out of three usually asks if they are saving enough money. I love when they ask me this question. Why? Because it’s really the first step many people take towards proper financial planning. I say this for one simple reason. In order to know […]

Is Your Retirement Safe?

No matter if you are already retired or still planning your retirement, you’re smart to think about the traps that might jeopardize your financial future. That way you can do something about it before it’s too late. Truth be told, most people I meet are anxious about their financial future anyway – at least a […]